hmmm......... in simple, not-arcane words, you might be confusing how these markets handle so-called "ancillary services" and energy. I'm not sure about the specifics of the ERCOT market in Texas, but notwithstanding that these are called "energy markets", to be viable - they must also recognize the basic laws of physics!

This means that in addition to pricing kWhrs, energy spot markets must also price ("value" is a better non-arcane word) ancillary service -somehow. Or said another way, separate to generators who derive revenue via bids for energy - those generators who provide facilities for system stability to the the market ( i.e. stuff like VARs, frequency control, system-black restart etc.) must get paid too.

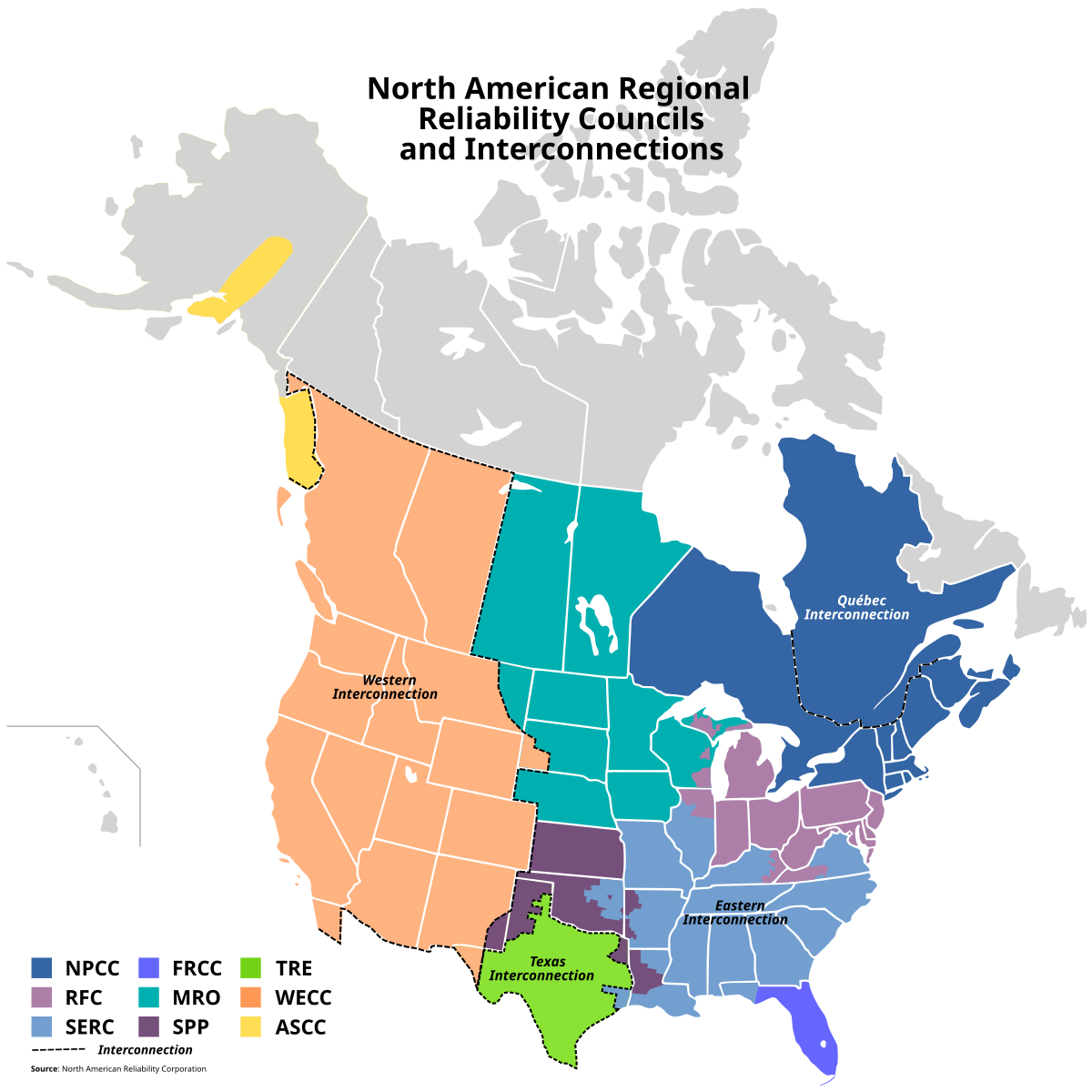

I would imagine that in a spot-market that is built on top of an electrical grid that is isolated from the rest of America, ancillary services would be an especially important part of ERCOTs design - particularly since the grid is prone to repetitive severe winter (summer?) events.

So yes, for Texas, I would think that how the grid (and therefore the market) responds to "instantaneous demand" does have an effect on energy (and therefore spot-price). But whether the grid survives at all to this "instantaneous demand" is probably less about how much generator capacity (KWs) was bid into the market at the time and more a question of whether ERCOT had sufficient ancillary service providers during the event.

As an example -

@Uwe pointed-out how wind turbines were shut down during the storms in Texas. Wind turbines are "price-takers" in spot markets because their dispatch can't be predicted. In high load conditions, losing wind turbine Kws is far less impacting on the market than losing the equivalent amount of thermal generator KWs, because the mass of the rotor in a thermal generator also provides frequency control to the grid.

Some energy markets separately price capacity and ancillary services before the clearing price is determined (called the "ex-ante" price), but the more common method is for the Market operator to contract for ancillary services on an annual basis.

If ERCOT uses the latter method, then I suspect that lots of disenfranchised users, regulators and government agencies will be looking carefully at the basis for the market operator's contracting decision!